The rise of digital currencies has brought new ways to handle money. Stablecoins, a type of cryptocurrency, offer the stability of being tied to traditional assets. In India, digital finance is changing rapidly with two key developments: the Reserve Bank of India’s (RBI) Central Bank Digital Currency (CBDC or e-rupee) and rupee-backed stablecoins. According to the Bank for International Settlements, digital currencies can reduce transaction costs by up to 50%. If implemented with proper regulations, the e-rupee and stablecoins could create a more efficient and inclusive digital economy in India.

What is Central Bank Digital Currency?

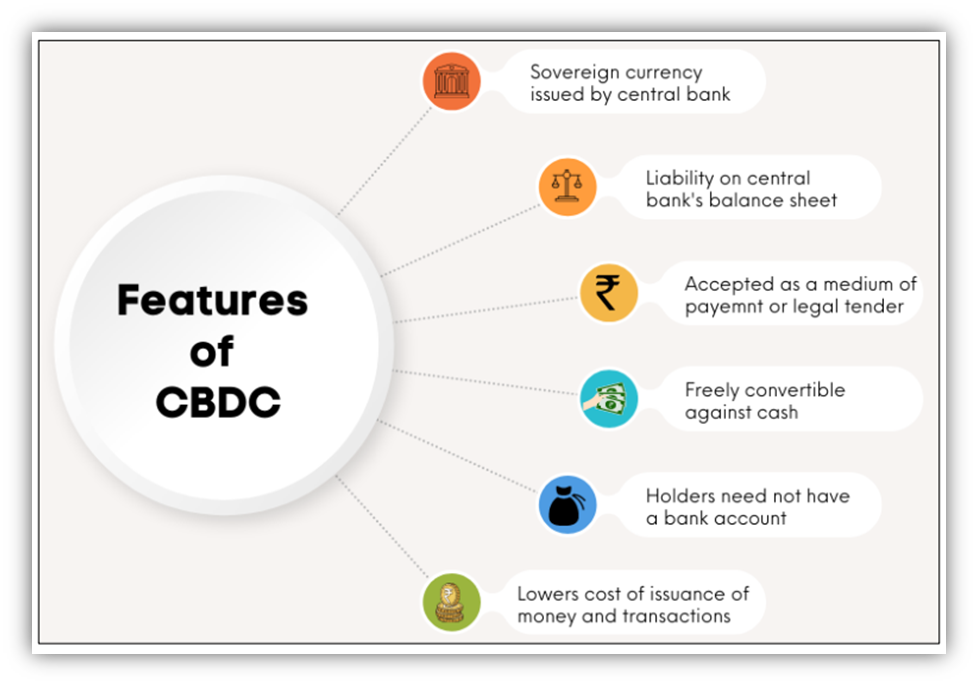

Definition: A Central Bank Digital Currency (CBDC) is a digital form of a country’s official currency issued and controlled by the central bank.

Benefits:

- Safer and easier than cash.

- Reduces costs linked to printing, distribution, and storage of money.

- Prevents risks like counterfeiting and theft.

- Promotes financial inclusion and cross-border payments.

- Helps in transitioning to a digital economy.

Types of CBDC (e-rupee):

- Retail CBDC:

- For private users like individuals and businesses.

- Acts as a digital version of cash for everyday transactions.

- Features:

- Safe and always available.

- Settles payments in real-time or near real-time.

- Wholesale CBDC:

- For interbank transactions like bond settlements and nostro transfers.

- Features:

- Used by select financial institutions.

- Improves security and efficiency in large-scale transactions.

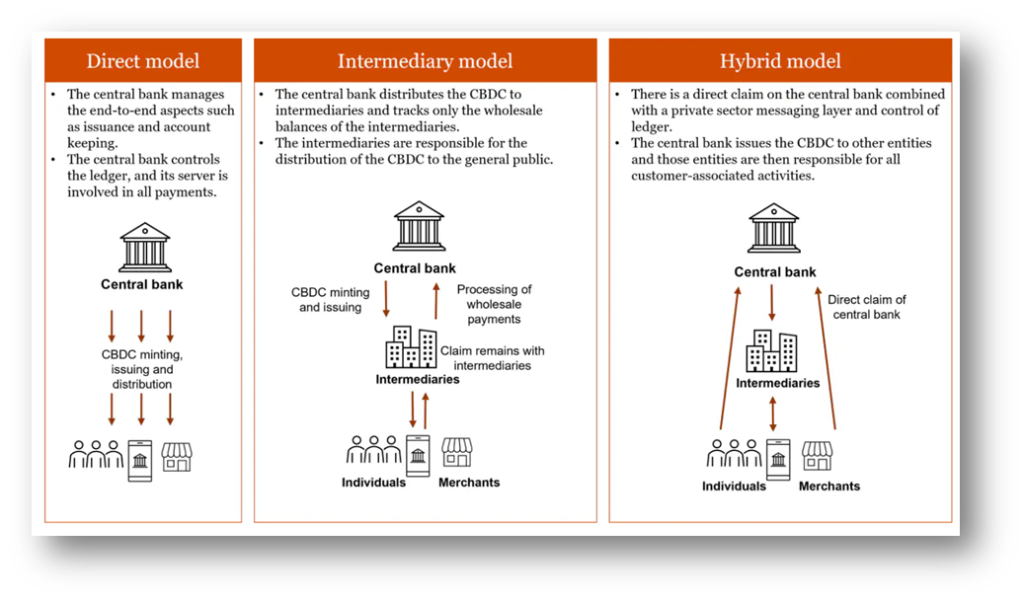

Mode of Issuance:

Key Benefits of Central Bank Digital Currency

- Enhanced Financial Inclusion:

- Helps unbanked and underbanked people access banking through mobile-based digital wallets.

- RBI plans offline CBDC-R functionality for areas with limited or no internet.

- Reduced Transaction Costs:

- Saves costs by eliminating the need to print and transport physical currency.

- For example, printing a Rs 100 note costs around Rs 15-17 over its four-year life, which CBDC can significantly reduce.

- Better Monetary Policy:

- Enables real-time monitoring of money flow.

- Helps target specific issues like hoarding or black-market activities.

- Example: RBI’s wholesale CBDC pilot in 2022 improved interbank settlements.

- Transparency and Reduced Crime:

- Traceable transactions can prevent corruption, tax evasion, and financial crimes.

- FATF estimates that only 1% of global illicit financial flows are recovered. CBDCs can change this with better tracking.

- Faster Cross-Border Payments:

- CBDCs can simplify and speed up international payments while reducing costs.

- Example: India’s G20 focus aims to lower remittance costs globally by 2027.

- The m-CBDC Bridge Project (with Thailand, Hong Kong, and UAE) showed near-instant settlements.

- Encourages Financial Innovation:

- Creates opportunities for fintech companies to develop new payment systems.

- Example: CBDCs can integrate with IoT for micropayments, boosting India’s smart city initiatives.

- India has the highest fintech adoption rate of 87% globally, and CBDCs can accelerate this trend.

- Crisis Resilience:

- Ensures seamless transactions during crises like pandemics or natural disasters.

- Example: During COVID-19, welfare funds could have been distributed faster using digital wallets powered by CBDCs.

- Supports De-Dollarization:

- Reduces reliance on foreign currencies like the US dollar.

- Example: India’s rupee-based trade agreements and RBI’s wholesale CBDC pilots for international trade.

Concerns with CBDC

- Cybersecurity and Privacy Risks:

- CBDC systems could attract cyberattacks, risking national financial security.

- Example: The 2020 SolarWinds attack impacted critical systems.

- High Costs:

- Developing and maintaining CBDC infrastructure is expensive.

- Example: Nigeria’s eNaira project incurred significant costs.

- Impact on Banks:

- CBDCs could reduce deposits in commercial banks, limiting their ability to lend.

- Example: Bank of England noted potential reductions in deposits by 4-12%.

- Technological Challenges:

- Many areas in India lack robust digital infrastructure.

- Example: Only 25% of rural India is digitally literate, and 45% of the population lacks internet access.

- Cross-Border Issues:

- Different global standards make CBDC integration difficult.

- Example: m-CBDC Bridge Project is different from the digital Euro or Digital Rupee.

- Economic Risks:

- Smaller economies might face dollarization risks if foreign CBDCs dominate.

- Example: El Salvador faced challenges with Bitcoin adoption.

Rupee-Backed Stablecoins and How They Complement CBDC

Definition:

- Rupee-backed stablecoins are digital tokens tied 1:1 to the Indian rupee. They operate on blockchain technology and offer fast, low-cost transactions.

- Unlike cryptocurrencies like Bitcoin, stablecoins are less volatile.

How Stablecoins Complement CBDCs:

- Cross-Border Payments:

- Stablecoins can fill gaps in international payments where CBDCs are not yet compatible.

- Encouraging Innovation:

- Enables decentralized finance (DeFi) and e-commerce platforms to grow.

- Bridging Financial Systems:

- Acts as a link between traditional finance, CBDCs, and blockchain ecosystems.

- Initial Support for CBDC Rollout:

- Serves as a temporary solution until CBDCs are fully functional.

Steps to Effectively Implement CBDC in India

- Strengthen Digital Infrastructure:

- Expand broadband access in rural areas through projects like BharatNet.

- Improve digital literacy with training programs.

- Enhance Cybersecurity:

- Use advanced encryption and AI-based monitoring.

- Collaborate with agencies like CERT-In for threat detection.

- Integrate with Existing Systems:

- CBDCs should work alongside current systems like UPI and Jan Dhan accounts.

- Example: Link CBDCs with Aadhaar for financial inclusion.

- Educate the Public:

- Conduct awareness campaigns to explain CBDC benefits.

- Example: RBI’s DigiDhan Mela model can be replicated.

- Develop Offline Capabilities:

- Enable offline CBDC use with technologies like NFC-enabled smart cards.

- RBI’s offline retail CBDC trials are promising.

- Ensure Global Interoperability:

- Align with global standards for cross-border payments.

- Example: G20’s roadmap emphasizes uniformity.

- Create a Legal Framework:

- Address issues like taxation and consumer protection.

- Example: Integrate the Personal Data Protection Act 2023 into the CBDC framework.

- Public-Private Partnerships (PPPs):

- Collaborate with fintech and blockchain startups to design efficient solutions.

- Example: Use private expertise for user-friendly CBDC applications.

By addressing these challenges and leveraging the strengths of both CBDCs and stablecoins, India can lead the way in building a robust, inclusive, and efficient digital financial system.