Introduction

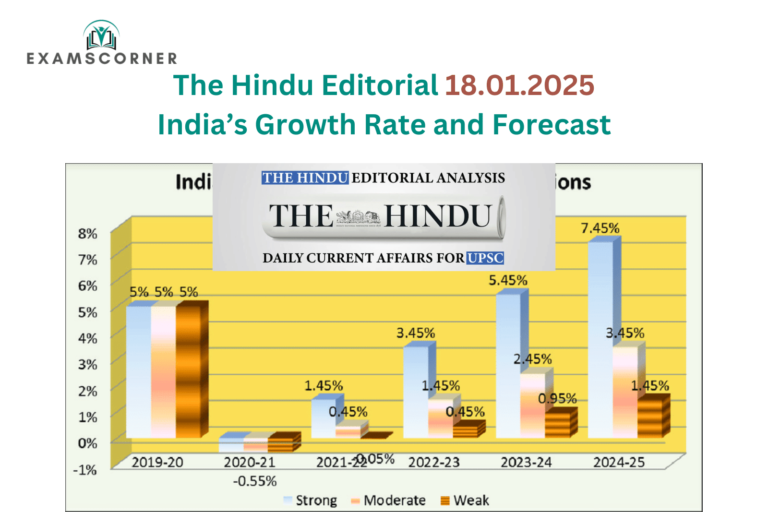

The First Advance Estimates (FAE) of National Accounts for 2024-25 indicate a real GDP growth of 6.4% and a nominal GDP growth of 9.7%. These figures fall slightly below the Reserve Bank of India’s revised growth estimate of 6.6% for real GDP and the 10.5% nominal GDP growth projected in the 2024-25 Union Budget.

The annual growth rate of 6.4% reflects a segmented performance: 6% growth in the first half of the fiscal year and 6.7% in the second half. Notably, this is an improvement over the Q2 growth of 5.4%. However, the sharp fall from 8.2% GDP growth in 2023-24 to 6.4% in 2024-25 is more pronounced when compared to GDP figures than Gross Value Added (GVA). The GVA difference is relatively modest, decreasing from 7.2% to 6.4%. The manufacturing sector’s steep decline, from 9.9% growth in 2023-24 to 5.3% in 2024-25, significantly contributes to this downturn.

Context: Over the next five years, India’s best-case scenario involves achieving a steady real GDP growth rate of 6.5%. This projection, while ambitious, hinges on several domestic and global factors, as well as strategic policy decisions.

Growth Prospects for 2025-26

Gross Fixed Capital Formation (GFCF) Rate

The GFCF rate at constant prices has stabilized between 33.3% and 33.5% during 2021-22 to 2024-25, with an average of 33.4%. This trend is expected to persist in 2025-26.

Incremental Capital Output Ratio (ICOR)

The ICOR, a critical efficiency metric, has averaged slightly above 5 in recent years. Assuming an ICOR of 5.1 for 2025-26, a 6.5% real GDP growth rate appears achievable.

Global Economy and Domestic Demand

Global economic conditions are expected to remain largely stable, despite uncertainties stemming from geopolitical developments such as Donald Trump’s assumption of office. India’s growth will predominantly depend on domestic demand. The Government of India’s role in sustaining investment expenditure will be pivotal.

Government Investment Expenditure

A slowdown in the Government’s investment growth has already impacted the 2024-25 GDP figures. Investment growth turned negative at (-)12.3% after eight months into the fiscal year. Ensuring no relaxation in investment expenditure will be crucial to maintaining growth momentum.

Nominal GDP Growth and Tax Revenue

Lower nominal GDP growth in 2024-25 at 9.7%, compared to the budgeted 10.5%, could impact Gross Tax Revenue (GTR). However, GTR growth during the first eight months of the fiscal year was 10.7%, indicating potential for minimal shortfall if this pace continues. A realized buoyancy of 1.1, higher than the budgeted 1.03, would mitigate revenue constraints and allow the government to meet its capital expenditure target of ₹11.1 lakh crore.

Reason for the Dip

Government Capital Expenditure

The limited capital expenditure of ₹5.14 lakh crore (46.2% of the budget target) after eight months has been the primary reason for the dip in 2024-25 GDP growth. While accelerated expenditure in the remaining months may reduce the shortfall, achieving the budget target remains unlikely.

Capital Expenditure Plans for 2025-26

To counter these challenges, the Government must maintain an accelerated capital expenditure growth of at least 20% based on the revised estimates for 2024-25. A robust investment expenditure strategy that catalyzes private investment will be essential.

Medium- to Long-Term Growth Prospects

Projected Real GDP Growth Rate

India’s projected real GDP growth rate over the next five years is 6.5%, consistent with the International Monetary Fund’s forecasts. This growth, accompanied by an implicit price deflator (IPD)-based inflation of about 4%, would result in nominal GDP growth of 10.5%-11%.

Global Conditions and Potential Growth

In years of favorable global conditions, significant net export contributions could push real GDP growth to 7%. However, sustaining a 6.5% growth rate over the long term will become increasingly challenging as the economic base expands.

Long-Term Projections and Per Capita GDP

If India maintains a real GDP growth of 6.5% and nominal GDP growth of 10.5%-11%, coupled with an average annual exchange rate depreciation of 2.5%, the country could achieve a per capita GDP level consistent with developed nation status within the next 25 years.

Challenges to Sustaining Growth

Achieving a 6.5% growth rate will require higher growth in the initial years. The current potential growth rate of 6.5% may evolve, influenced by structural reforms and economic conditions.

Conclusion

India’s potential growth rate of 6.5% places the 6.4% real GDP growth estimate for 2024-25 in a positive light. The exceptional 8.2% growth in 2023-24 should be viewed as an outlier rather than a benchmark. The 6.4% growth rate for 2024-25, as indicated in the FAE, aligns with India’s long-term economic trajectory and underscores the importance of sustained investment, structural reforms, and domestic demand in driving future growth.